how to claim eic on taxes

Senior research associate at the Urban. If you received a letter from the IRS about the Earned Income Tax Credit EITC also called EIC the Child Tax CreditAdditional Child Tax Credit CTCACTC or the American.

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

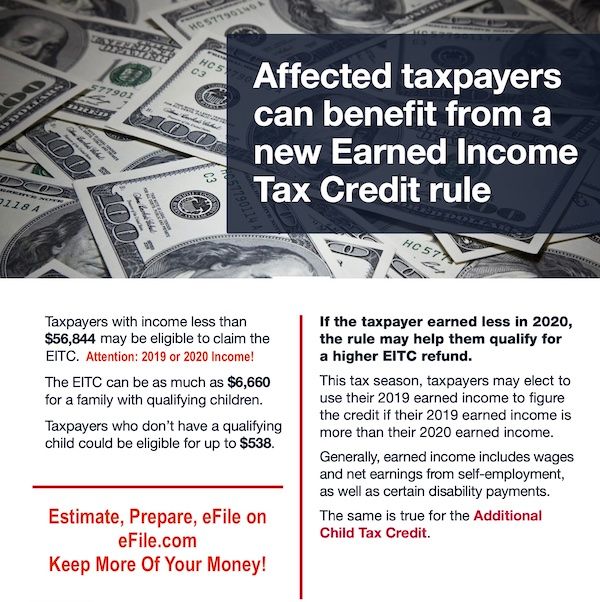

The Earned Income Tax Credit EITC or EIC is a refundable tax credit.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You may claim the Earned Income Tax Credit EITC for a child if you meet the rules for a qualifying child. Enter a 1 or 2 in the field labeled Elect to use 2020 earned income and nontaxable combat pay.

To qualify for the EITC a qualifying child must. The District Earned Income Tax Credit DC EITC is a refundable credit for low and moderate-income workers. You must claim all deductions allowed and resulting from your business.

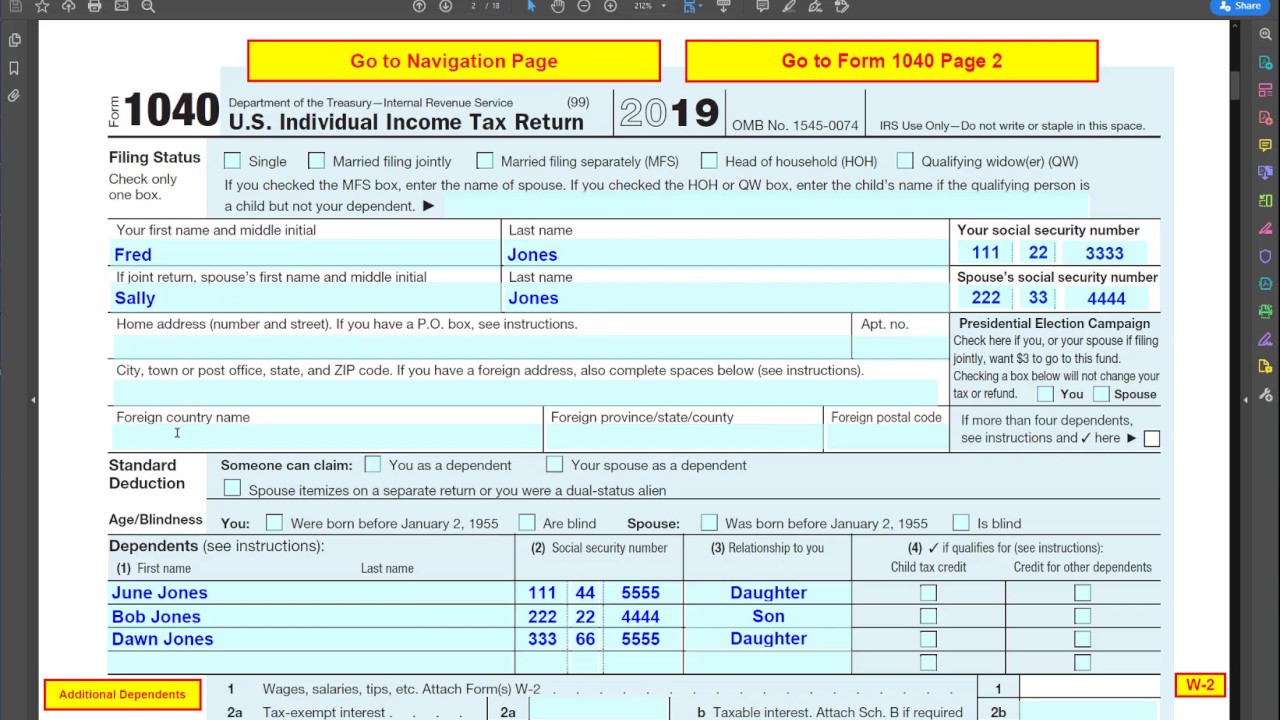

To claim the EITC taxpayers need to file a Form 1040. First you have to qualify. Your self-employment income minus expenses counts as earned income for the Earned Income Credit EIC.

If you qualify you can use the credit to reduce the taxes you owe. If the taxpayer is claiming the EITC with a qualifying child they must also complete and attach the Schedule EIC. On the other hand this tax season the Earned Income Credit is worth as much as 6660 for families with 3 or more eligible children.

That means even if your tax liability is zero if you qualify for the EITC the credit will be paid to you. FreeTaxUSA has what you need. Finally if you have one or more kids they have to qualify too for you to receive a larger credit.

You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. Then your income has to be within stated limits. For individuals with qualifying children the DC EITC is based on a.

Also include on line 1 any Medicaid waiver payments you received that you choose to include in earned income for purposes of claiming a credit or other tax benefit even. Complete Edit or Print Tax Forms Instantly. You need to complete an IRS Form Schedule EIC Earned Income Credit and file it with your return if youre claiming a qualifying child.

If you have a qualifying child you must file the Schedule EIC listing the children. You can remove the EIC from your return in TurboTax by following the instructions below. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Ad Edit Sign Print Fill Online IRS Notice 797 more Subscribe Now. Child Tax Credit EITC and More Supported. If the residency requirement for a qualifying child is not met your.

Ad Access IRS Tax Forms. Ad Claim the Credits and Deductions You Deserve. Locate the 2020 Earned Income Election for EIC andor Additional CTC subsection.

June 6 2019 908 AM. To claim EITC you must file a tax return even if you do not owe any tax or are not required to file. For the 2021 tax year the earned income credit ranges from.

The online tax app will automatically determine if you qualify for the Earned Income Credit. How to claim the EITC. If you dont have a qualifying child you.

The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. To make this election enter. To claim the EITC generally the child must have lived with the taxpayer in the United States for more than half of the year.

It was created to. IRS E-File Fast Refunds Always Free.

How To Claim An Earned Income Credit By Electronically Filing Irs Form 8862

Irs Courseware Link Learn Taxes

2021 Schedule Eic Form And Instructions Form 1040

Eic Frequently Asked Questions Eic

Summary Of Eitc Letters Notices H R Block

Two Websites To Get Your W2 Form Online Online Taxes Filing Taxes W2 Forms

Form 1040 Earned Income Credit Child Tax Credit Youtube

Here S What You Need To Know About The Earned Income Tax Credit In 2021

What Is The Earned Income Credit Check City

.png)

What Is The Earned Income Credit Check City

Earned Income Tax Credit 2013 1040return File 1040 1040ez And 1040a Forms Online

Earned Income Tax Credit Which Is The Required Income Limit To Apply Marca

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Tax Filing Without The Headaches Illinois Earned Income Tax Credit Simplified Filing Pilot